This is a summary of our performance for the FY2023-24. You can find more information in our Financial Report and Performance Statement from our Independent Auditor in the full annual report.

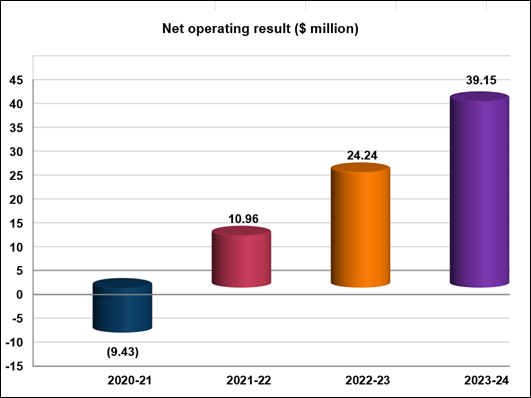

Operating position

Council’s operating surplus for 2023-24 is $39.15 million. This is significantly higher than the original budget surplus of $14.37 million. The favourable variance is mainly attributed to the net gain from the sale of Serpells Lane and the divestment of the Boroondara Tennis Centre to the Victorian State Government. Additionally, higher than expected interest rates led to increased returns on investments, and developer open space contributions exceeded expectations. However, this favourable outcome was partially offset by increased payments for materials and services and lower than anticipated capital grants.

The adjusted underlying result of Council, after removing non-recurrent capital grant income, monetary contributions and non-monetary asset contributions, is $24.26 million.

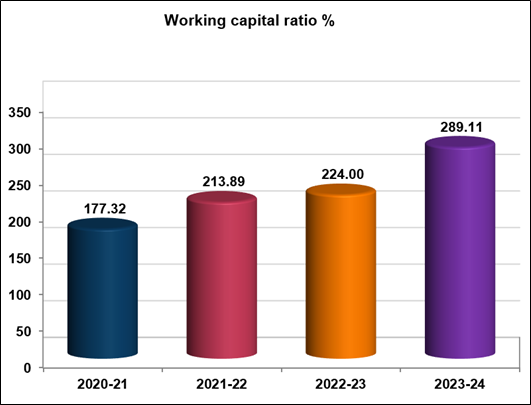

Liquidity

The working capital ratio, which assesses Council’s ability to meet current commitments, is calculated by measuring our current assets as a percentage of current liabilities. Our result of 289% indicates a satisfactory financial position.

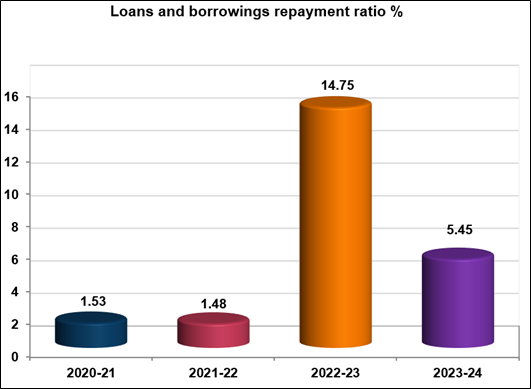

Obligations

Council ensures it maintains infrastructure assets at expected levels while continuing to deliver the services needed by the community. We invested $50.24 million in renewal works including the renewal of buildings ($15.80 million), roads ($13 million) and drainage ($6.22 million) during 2023-24. This was funded from capital grants of $7.6 million and cash flow from operations of $42.64 million. At the end of 2023-24, Council’s loans and borrowings repayment ratio — measured by comparing interest-bearing loans and borrowing repayments to rate revenue — was 5.45%. This decreased significantly to the prior year value of 14.75%. The increased percentage in 2022-23 is due to the full repayment of the NAB loan balance. All existing borrowings are projected to be repaid by 2033.

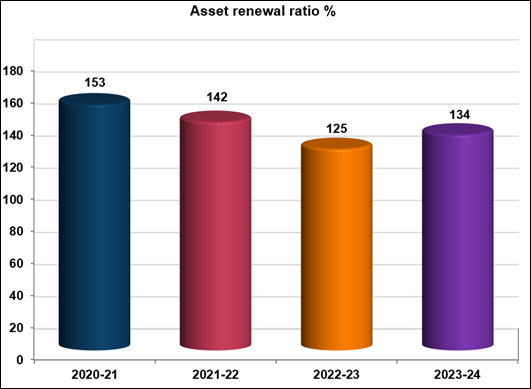

Asset renewal ratio is measured by comparing asset renewal and upgrade expenditure to depreciation and was 134% in 2023-24. This is an increase on previous years due to a review of the timing of planned renewal projects, resulting in some planned works being deferred to be undertaken in future years.

Stability and efficiency

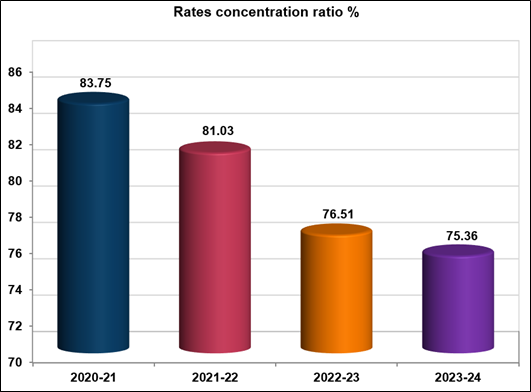

Council generates revenue from rates, user fees, fines, grants, and contributions. For 2023-24, the rates concentration, which compares rate revenue to adjusted underlying revenue, was 75.36%. The Council heavily relies on rates due to statutory restrictions on many fees and charges, and the insufficient increase in payments from the Victorian State Government to adequately fund services. In 2023-24, the adjusted underlying revenue improved due to a net gain from the disposal of property, infrastructure, plant and equipment, specifically from the sale of Serpells Lane and the divestment of the Boroondara Tennis Centre by the North East Link Project. Excluding these items, the rates concentration would be 78%. This was partially offset by a reduction in grants from the Federal Assistance Grants, as 100% of the 2023-24 allocation ($5.35 million) was paid in the 2022-23 financial year.