Council Budget 2023–24

Council Budget 2023–24 ewilliamWe have prepared our Budget 2023–24 in line with our commitment to sustainable budgeting, responsible financial management and the Victorian Government’s rate cap for 2023–24. Our budget also supports our community vision and priority themes in the Boroondara Community Plan 2021–2031.

Our budget aims to maintain and improve services and infrastructure, as well as deliver projects and services that are valued by our community.

We predict that this budget will have a surplus of $14.37 million. This is an increase of $1.41 million from the 2022–23 forecast.

In 2023–24, we will continue to invest in the delivery of services to our community, including:

- libraries

- health and wellbeing services

- family services

- youth services

- active ageing services.

We will also continue to invest in our infrastructure assets. This includes renewal works and new works for:

- roads

- footpaths and bicycle paths

- drainage

- recreational, leisure and community facilities

- parks, open spaces and streetscapes

- buildings.

We are confident the Budget 2023–24 responds to our communities’ priorities and shows how we are creating ‘a sustainable and inclusive community’.

Read the original Council Budget 2023–24

Total revenue and spending

Total revenue and spending ewilliam| Description | 2023–24 | 2022–23 |

|---|---|---|

| Total revenue | $275.50 million | $270.81 million |

| Total spending | $261.14 million | $257.86 million |

| Account result | $14.37 million | $12.96 million |

|

Underlying operating result (This is an important measure of financial sustainability because it excludes capital income from being allocated to cover operating expenses) |

$6.72 million | –$6.63 million |

We have adjusted the 2023–24 surplus result by $7.64 million as this relates to capital grants and open space contributions.

We have adjusted the 2022–23 deficit result by $19.59 million as this relates to capital grants and open space contributions.

Key investments for 2023–24

Key investments for 2023–24 ewilliamOur 2023–24 Budget focuses on investing in high-quality, sustainable and inclusive community services and facilities.

This includes:

- $20.46 million over 3 years for the Kew Library redevelopment, which is due to be completed in 2025–26

- $431,329 for the Glenferrie Oval precinct, which will include demolishing the Ferguson Stand and creating new public open space

- $27.45 million over 4 years to upgrade the Michael Tuck Stand, which is due to be completed in 2026–27

- $8.13 million for several sportsground pavilion renewals at Willsmere Park, Canterbury Sportsground, Lynden Park and Ferndale Park.

Investments into preserving and increasing green space

We are investing in our sportsgrounds, which includes:

- $2.11 million for ground reconstructions

- $1 million for the playing surface at Dorothy Laver West Reserve

- $2.09 million for the redevelopment of Ferndale Park Pavilion.

We understand there is limited open space in our community for recreation. We will invest $800,000 each year into our Open Space Acquisition Fund, which allows us to purchase additional open space when there is an opportunity.

Investments into sustainability

We have committed $1 million to continue delivering a range of initiatives to reduce Council's emissions and meet other climate-related targets in our Climate Action Plan.

We are also investing:

- $230,000 to continue our Biodiversity Strategy to expand and maintain our significant biodiversity sites

- $255,000 to continue reducing waste sent to landfill by expanding our FOGO service to commercial and food businesses

- $275,000 to install solar lights along paths in parks and other outdoor community spaces.

Investments into maintaining our infrastructure

We will invest:

- $5.2 million for drainage renewal

- $2.4 million for footpath and cycleway renewal

- $13.8 million for road renewal

- $10.5 million for 7 other community building renewal works and minor works across many other properties we manage.

Investments into services

We will invest:

- $10.3 million to provide library services 7 days a week

- $9.4 million on health and wellbeing services, including immunisation, youth and recreation services

- $20.9 million for parks and gardens, biodiversity and street trees maintenance

- $3.7 million on arts and cultural services and events

- $12.7 million for planning, development and building controls

- $12.4 million for maintenance of the city’s infrastructure, including buildings, drainage, footpaths, roads and shopping centres.

We will support a program of health and wellbeing activities for those with disproportionately poorer health outcomes, such as LGBTQIA+ communities, young people and others experiencing social isolation and loneliness. This will include bi-annual community roundtables to hear the voices of LGBTQIA+ communities, and to plan and Introduction 3 deliver practical outcomes to support inclusion through programs, projects and activities, $90,000 has been allocated.

What affected our 2023–24 Budget

What affected our 2023–24 Budget ewilliamExternal influences

Victorian Government

The Victorian Government influence on our budget includes:

- the Victorian Government’s rate cap increase of 3.5%

- the Victorian Government waste levy is expected to increase by 2.68% or $3.37 per tonne from $125.90 to $129.27 per tonne in 2023–24. The waste levy changes are part of the Victorian Government’s Recycling Victoria package. This is a 10-year action plan to encourage more recycling and reduce waste going to landfill

- the Victorian Government announced changes to the Workers Compensation system due to the scheme’s financial losses. As a result, the Victorian Government has increased average premiums from 1.27% of remuneration to 1.80% of remuneration, resulting in an average 42% increase in all Victorian Workers Compensation premiums

- the Fire Services Property Levy that we collect for the Victorian Government

- ongoing cost shifting. This happens when a local government provides a service to the community on behalf of the Victorian or Australian Government. Over time, the cost for providing the service goes up, but the funding a local government receives doesn’t match it.

Grant funding

We will receive $3.24 million for capital works grant funding from the Australian Government.

This includes:

- $2.05 million for Walmer Street Bridge upgrades

- $593,811 for the Local Roads and Community Infrastructure (LRCI) Program. This program will deliver priority road and community infrastructure projects

- $593,811 for Roads to Recovery Program funding covering roads pavement renewal works.

Internal influences

Internal influences on our budget include projects that aren’t finished or haven’t started yet. This can be because of planning issues, weather delays or a longer consultation with the community.

Employee costs are another internal influence. These are mostly driven by Council’s Enterprise Agreement. We have included an annual increase of 3% for all costs related to employees, such as wages, Work Cover and superannuation. In 2023–24 the compulsory Superannuation Guarantee Scheme (SGC) will also increase from 10.50% to 11.00%.

Waste collection costs will also increase in 2023–24 by roughly 5.6%. This is linked directly to the cost of providing the waste services.

How the Budget supports our Community Plan

How the Budget supports our Community Plan ewilliamIn this section, we list the 7 themes of the Boroondara Community Plan and the services that fall under each of these themes. We detail the amount that each service costs, the amount we will make in revenue and the total net cost of that service.

Theme 1 – Community, Services and Facilities

Arts and Culture

Expenditure: $3,655,000

Revenue: –$586,000

Net cost: $3,069,000

Asset Management

Expenditure: $3,522,000

Revenue: $0

Net cost: $3,522,000

Capital Projects

Expenditure: $2,986,000

Revenue: –$15,000

Net cost: $2,971,000

Civic Services

Expenditure: $8,562,000

Revenue: –$6,252,000

Net cost: $2,310,000

Community Planning and Development

Expenditure: $4,264,000

Revenue: –$296,000

Net cost: $3,968,000

Health and Wellbeing

Expenditure: $9,353,000

Revenue: –$5,633,000

Net cost: $3,720,000

Infrastructure Maintenance

Expenditure: $12,506,000

Revenue: –$128,000

Net cost: $12,378,000

Liveable Communities

Expenditure: $3,816,000

Revenue: –$1,816,000

Net cost: $2,000,000

Library Services

Expenditure: $10,330,000

Revenue: –$1,262,000

Net cost: $9,068,000

Theme 2 – Parks and Green Spaces

Infrastructure Maintenance

Expenditure: $858,000

Revenue: $0

Net cost: $858,000

Landscape and Design

Expenditure: $485,000

Revenue: $0

Net cost: $485,000

Open Space

Expenditure: $16,761,000

Revenue: –$1,166,000

Net cost: $15,595,000

.

Theme 3 – The Environment

Environmental Sustainability

Expenditure: $1,663,000

Revenue: $0

Net cost: $1,663,000

Drainage Management

Expenditure: $649,000

Revenue: –$82,000

Net cost: $567,000

Open Space

Expenditure: $1,620,000

Revenue: $0

Net cost: $1,620,000

Planning and Placemaking

Expenditure: $676,000

Revenue: –$383,000

Net cost: $293,000

Waste and Recycling

Expenditure: $27,410,000

Revenue: –$1,553,000

Net cost: $25,857,000

Theme 4 – Neighbourhood Character and Heritage

Asset Protection

Expenditure: $1,422,000

Revenue: –$3,149,000

Net cost: –$1,727,000

Building Services

Expenditure: $2,675,000

Revenue: –$1,692,000

Net cost: $983,000

Planning and Placemaking

Expenditure: $8,452,000

Revenue: –$2,303,000

Net cost: $6,149,000

.

Theme 5 – Moving Around

Civic Services

Expenditure: $4,446,000

Revenue: –$14,711,000

Net cost: –$10,265,000

Road Maintenance and Repair

Expenditure: $1,332,000

Revenue: –$64,000

Net cost: $1,268,000

Traffic and Transport

Expenditure: $1,640,000

Revenue: $0

Net cost: $1,640,000

.

Theme 6 – Local Economy

Local Economies

Expenditure: $3,621,000

Revenue: –$1,598,000

Net cost: $2,023,000

Minor shopping centre upgrade and maintenance

Expenditure: $356,000

Revenue: $0

Net cost: $356,000

.

.

Theme 7 – Governance and Leadership

Chief Financial Office

Expenditure: $7,359,000

Revenue: –$3,552,000

Net cost: $3,807,000

Council Operations

Expenditure: $389,000

Revenue: $0

Net cost: $389,000

Councillors, Chief Executive Officer, Executive Management and support staff

Expenditure: $3,030,000

Revenue: $0

Net cost: $3,030,000

Customer Support and Corporate Information

Expenditure: $7,644,000

Revenue: $0

Net cost: $7,644,000

Digital

Expenditure: $1,743,000

Revenue: $0

Net cost: $1,743,000

Digital Experience

Expenditure: $639,000

Revenue: $0

Net cost: $639,000

Governance and Legal

Expenditure: $5,796,000

Revenue: –$51,000

Net cost: $5,745,000

Information Technology

Expenditure: $11,527,000

Revenue: $0

Net cost: $11,527,000

People, Culture and Development

Expenditure: $3,896,000

Revenue: $0

Net cost: $3,896,000

Strategic Communications

Expenditure: $4,010,000

Revenue: $0

Net cost: $4,010,000

Strategy and Performance

Expenditure: $2,133,000

Revenue: $0

Net cost: $2,133,000

.

Summary of our financial position

Summary of our financial position ewilliamSummary of our financial position

This summary provides important information about our:

- operating result

- services we deliver to the community

- cash and investments

- Capital Works Program.

The following graphs show the 2022–23 forecast actual, which is marked with an F before the date.

The graphs also show the budget for 2023–24, 2024–25, 2025–26 and 2026–27. These are marked with a B before the date.

Operating result

The operating result recognises all revenue and spending for Council to operate and includes non-cash items like depreciation.

We expect our operating result for the 2023–24 year to be a surplus of $14.37 million. This is a $1.41 million increase from the forecast surplus result of $12.96 million for 2022–23.

The operating result and future years can change depending on the number of priority projects planned.

Our adjusted underlying result is a surplus of $6.72 million, which is an increase of $13.35 million over 2022–23. The adjusted underlying result doesn’t include items such as capital grants, non-cash contributions and cash capital contributions.

The forecast underlying result for the 2022–23 year is a deficit of $6.63 million. The 2023–24 adjusted underlying result doesn’t include capital grants and contributions totalling $7.64 million.

When we talk about a surplus or deficit, this isn’t a measure of ‘profit’. It tells us about the capacity we have to fund future capital works.

.

Services we deliver to the community

The net cost of services we deliver to the community includes the net costs to run services after receiving income from them, as well as net spending on priority projects. For the 2023–24 year, we expect the net cost of services we deliver to be $159.24 million. This is a decrease of $750,000 over 2022–23.

.

Cash and investments

We use cash and investments to fund the Capital Works Program and repay existing borrowings.

In our budget, we have decreased cash and investments by $21.52 million to $106.65 million for the year ending 30 June 2024.

Council refinanced loan borrowings of $19.70 million during the 2022–23 year to fund strategic capital works projects. We aren’t proposing any new borrowings during the 2023–24 financial year.

.

Capital Works Program

Our commitment to capital works will reach $80.60 million for the 2023–24 financial year. Of this amount, $6.60 million is for commitments we carried over from the 2022–23 year. These commitments are fully funded from the 2022–23 Budget.

To achieve our commitment to capital works:

- we refinanced loan borrowings of $19.70 million during the 2022–23 year

- we will use $3.24 million of capital funding from successful grant applications

- we have committed to spend $54.46 million for renewal projects. We have also committed to spend $26.14 million for new, upgrade and expansion projects. This includes commitments we have carried over.

You can find out more on our Capital Works Program 2023–24 page.

.

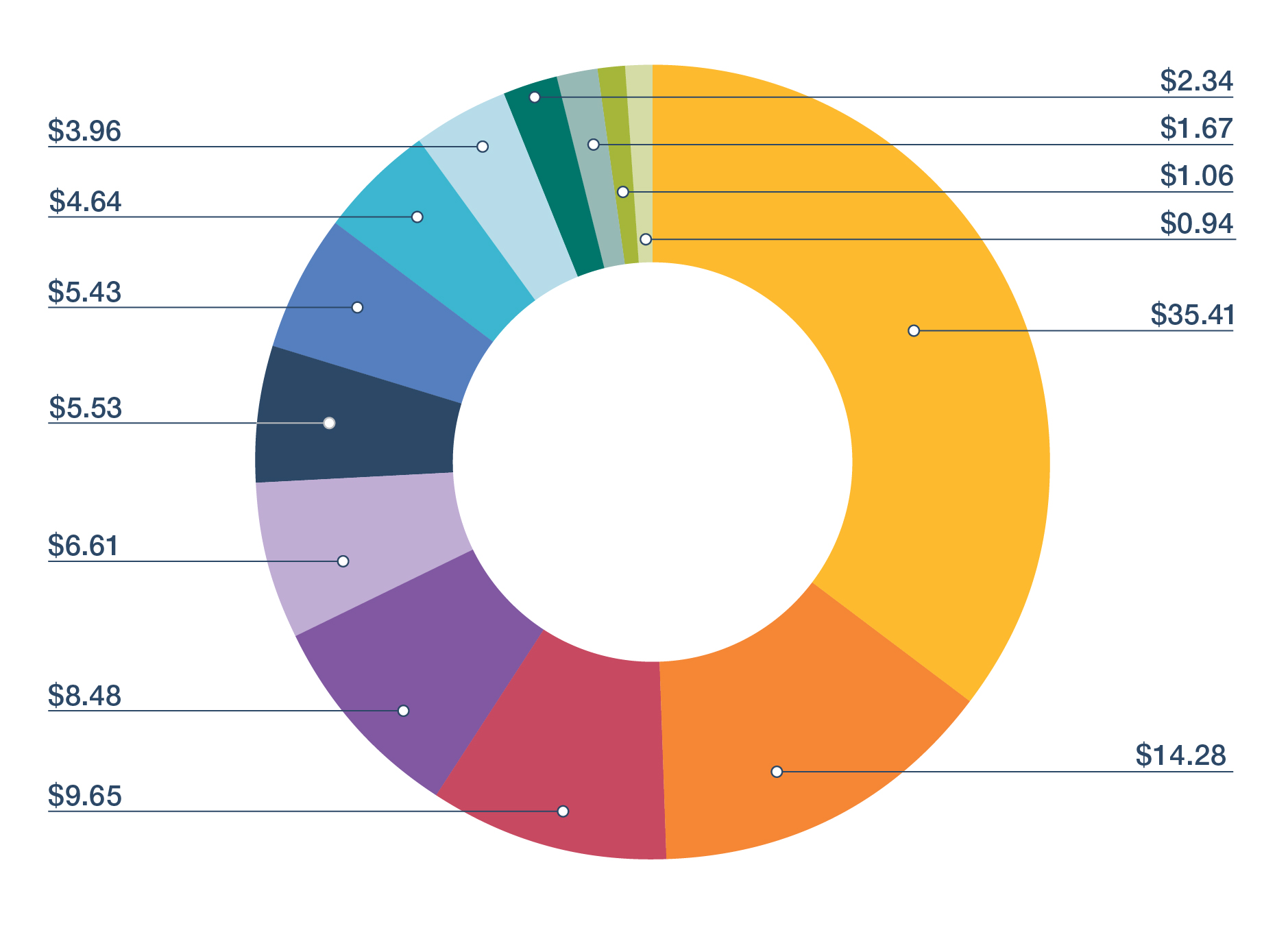

How we spend money across services

We have broken down how we spend money across the main services we deliver. For every $100 we spend:

- $35.41 is for Capital works and priority projects

- $14.28 is for Environment and waste management

- $9.65 is for Parks, gardens and sportsgrounds

- $8.48 is for Health, aged community and family services

- $6.61 is for Library, arts and cultural services

- $5.53 is for Planning and building

- $5.43 is for Local laws enforcement

- $4.64 is for Roads, footpaths, safety and drainage

- $3.96 is for Communications and customer service

- $2.34 is for Engineering and traffic

- $1.67 is for Rates and property services

- $1.06 is for Leisure and recreation and civic centres

- $0.94 is for Economic development.

Financial statements

Financial statements ewilliamOur financial statements include projections for the 4 years ending 30 June 2027.

They are prepared in line with the Local Government Act 2020 and the Local Government (Planning and Reporting) Regulations 2020.

Comprehensive Income Statement

Find information about the income and expenses for the 4 years ending 30 June 2027.

Balance Sheet

Find information about:

- current assets

- non-current assets

- current liabilities

- non-current liabilities.

Statement of Changes in Equity

Find information about the:

- balance at beginning of the financial year

- surplus (or deficit) for the year

- net asset revaluation increase (or decrease) of Council’s assets, such as property, infrastructure, plant and equipment

- transfer to or from our other reserves, including our Open Space Reserve, Defined Benefits Superannuation call up fund, Strategic Acquisition Fund and the Drainage Reserve

- balance at end of the financial year.

Statement of Cash Flows

Find information about the cash flows from:

- operating activities

- investing activities

- financing activities.

Statement of Capital Works

Find information about the:

- budget for property projects

- budget for plant and equipment projects

- budget for infrastructure projects

- funding sources, including grants, contributions, asset sales, Council cash and borrowings.

Statement of Human Resources

Find information about our staff expenses and our staff numbers.

How we measure our performance

How we measure our performance ewilliamFind out about our current and projected performance for services, finance and sustainability.

We are required to report on our performance against a common set of indicators. These indicators are in Schedule 4 of the Local Government (Planning and Reporting) Regulations 2020. They give a useful analysis of our financial position and performance.

For example, we looked at the satisfaction level of our community with how Council makes and implements decisions. We measured this satisfaction level by asking our community for a rating out of 100 for our consultation and engagement efforts.

We also looked at performance against other indicators, such as:

- decision making

- participation

- waste diversion

- health and safety

- loans and borrowings

- level of debt

- population

- disadvantage

- workforce turnover.

We will report results against these indicators in the Performance Statement of our Annual Report.

Fees and charges

Fees and charges ewilliamWe provide a range of services to the Boroondara community. To pay for these services, we either charge a fee to use them or we apply a levy.

Our Pricing Policy makes sure that we set fees in line with activities to support community objectives. These are activities that we wouldn't normally do, however, the Victorian or Australian Government has requested and funded them to meet a certain objective.

When we set fees and charges, we think about:

- people’s ability to pay

- equity in how services are subsidised

- community service obligations

- legal or service agreement limitations, such as building permits or statutory planning fees

- results from benchmarking of similar services.

Our fees and charges also might change throughout the 2023–24 year. However, if fees are set by the Victorian Government, we aren’t able to change them.

Waste management fees

We charge waste management fees to pay for:

- the waste to landfill service

- the food organics and green organics waste service

- the recycling service

- hard-waste collection

- operating the Riversdale Road Transfer Station

- post closure management of the Clayton Landfill

- delivering street sweeping services

- public place waste and recycling services

- bin renewal

- disposing of electronic waste.

We also charge waste management fees to pay for waste collection at:

- public parks

- gardens

- sportsgrounds

- community buildings.

In our 2023–24 Budget, we are proposing an average increase of 5.6% for waste charges in Boroondara, which factors in the Victorian Government waste levy. This levy is part of the Victorian Government's Recycling Victoria package, which is a 10-year action plan to encourage more recycling and reduce waste to landfill.

The Victorian Government waste levy is $129.27 per tonne in 2023–24.

Waste bin charges for 2023–24

| Household waste bin size (landfill) | 2022–23 charge | 2023–24 charge |

|---|---|---|

| Waste environment levy residential and other | $120 | $126 |

| Waste environment levy commercial | $120 | $126 |

| 80-litre and minimum waste charge residential and other | $262 | $276 |

| 80-litre commercial | $262 | $276 |

| 120-litre residential and other | $477 | $502 |

| 120-litre commercial | $477 | $502 |

| 240-litre (only for residential properties with 4 or more people in a household) | $1,161 | $1,224 |

| 240-litre commercial (only for commercial properties) | $1,161 | $1,224 |

| 240-litre concession (concessional fee for residential properties with a specific medical condition) | $955 | $1,000 |

2023–24 Rates

2023–24 Rates ewilliamRate percentage increases

The Local Government Act 2020 requires us to have a Revenue and Rating Plan. This is a plan for how we will generate income to deliver the Council Plan, programs and services, and capital works commitments for the next 4 years.

Our rates and charges are an important source of revenue. They make up 77% of the total revenue we receive each year.

The Minister for Local Government announced that the average property rate cap for 2023–24 will rise by 3.5%. We won’t be asking for any changes to this rate cap.

Future years are estimated using the Department of Treasury and Finance forecasts of the consumer price index. However, we are taking a conservative approach to the rate cap and set this at 2.5% for future years.

| Year | Rate increase % |

|---|---|

| 2024 | 3.5% |

| 2025 | 2.5% |

| 2026 | 2.5% |

| 2027 | 2.5% |

| 2028 | 2.5% |

Forecast of our rates and charges

The table below is an overview of our rates and charges. It shows what we forecast in 2022–23 compared to the actual 2023–24 budget.

| Type or class of land | Forecast actual 2022–23 | Budget 2023–24 | Change in dollars | Change in percentage |

|---|---|---|---|---|

| General rates | $169,984,617 | $176,805,537 | $6,820,920 | 3.9% |

| Supplementary rates and adjustments | $900,000 | $900,000 | $0 | 0% |

| Waste management charge | $31,686,000 | $33,466,000 | $1,780,000 | 5.6% |

| Interest on rates and charges | $550,000 | $550,000 | $0 | 0% |

| Special rate schemes | $1,374,555 | $1,449,130 | $74,575 | 5.1% |

| Less early payment discount | –$857,016 | –$1,168,665 | –$311,649 | 26.7% |

| Cultural Recreation charges | $56,002 | $56,360 | $358 | 0.6% |

| Total rates and charges | $203,694,158 | $212,058,362 | $8,364,204 | 3.9% |

Rates and property value

The Valuer General of Victoria took over the rateable property general valuation process on 1 July 2018. It also changed this process to happen every year instead of every 2 years.

Under the Local Government Act 1989, local governments can increase rate revenue through valuations of properties. The Valuer General of Victoria works out and certifies the Capital Improved Value (CIV) of properties. We then use the CIV to work out the rates.

The way rates are charged is the same for residential and business properties.

General revaluation of properties

General revaluation of properties ewilliamIn 2023–24, we found that the value of property across Boroondara has increased by 1.80%. This includes a 1.61% increase in value for residential properties and a 4.67% increase in value for non-residential properties compared to the last financial year.

We also found out there will be an increase in the rate in the dollar paid by ratepayers. This will be an increase from 0.12653020 cents in the dollar to 0.12864561 cents in the dollar.

A property in Boroondara at the median residential valuation in 2022 was valued at $1,500,000 with a general rate of $1,897.96. The new median valuation for 2023, according to the Valuer General of Victoria, is $1,600,000 and now attracts a general rate of $2,058.33. This is an increase in 2023–24 of $160.38 per year or $3.08 per week.

It’s important to note that when a revaluation is carried out, the total rate revenue that we receive doesn’t change. We don’t make any extra revenue.

A revaluation can change how the rates between properties are allocated. If the value of a property is higher than the average value for other properties, that property receives a higher rate increase compared to the general rate increase for other properties.

However, if the value of a property changes to become less than average, that property receives a lower rate increase compared to the general rate increase for other properties.

The following tables summarise the valuation changes between the 2022 and 2023 general revaluations for all property types including analysis by suburb.

All property types

| Property type | Number of properties | 2022 CIV | 2023 CIV | CIV % change |

|---|---|---|---|---|

| Residential Vacant Land | 887 | $1,988,880,000 | $1,949,910,000 | –1.96% |

| Houses | 41,211 | $99,785,620,000 | $101,256,975,000 | 1.47% |

| Flats | 1,747 | $1,052,720,000 | $1,064,860,000 | 1.15% |

| Units | 30,400 | $23,957,770,500 | $24,551,645,000 | 2.48% |

| Specialty (Retirement) | 18 | $131,550,000 | $142,550,000 | 8.36% |

| Non-residential – rateable | 5,776 | $8,092,285,000 | $8,470,177,500 | 4.67% |

| Total | 80,039 | $135,008,825,500 | $137,436,117,500 | 1.80% |

Analysis by suburbs – all property types

| Property type | Number of properties | 2022 CIV | 2023 CIV | CIV % change |

|---|---|---|---|---|

| Ashburton | 3,336 | $5,140,655,000 | $5,244,795,000 | 2.03% |

| Balwyn | 6,456 | $11,131,722,500 | $11,501,437,500 | 3.32% |

| Balwyn North | 8,350 | $15,586,440,000 | $15,578,795,000 | – 0.05% |

| Camberwell | 10,392 | $18,832,760,000 | $19,439,510,000 | 3.22% |

| Canterbury | 3,414 | $8,204,790,000 | $8,464,205,000 | 3.16% |

| Deepdene | 1,002 | $2,160,205,000 | $2,234,525,000 | 3.44% |

| Glen Iris | 6,546 | $11,674,400,000 | $12,066,215,000 | 3.36% |

| Hawthorn | 13,583 | $18,190,365,000 | $18,318,422,500 | 0.70% |

| Hawthorn East | 8,598 | $11,641,180,500 | $11,860,795,000 | 1.89% |

| Kew | 11,601 | $21,480,592,500 | $21,472,447,500 | – 0.04% |

| Kew East | 2,925 | $4,519,860,000 | $4,631,010,000 | 2.46% |

| Mont Albert | 59 | $135,225,000 | $139,025,000 | 2.81% |

| Surrey Hills | 3,777 | $6,310,630,000 | $6,484,935,000 | 2.76% |

| Total | 80,039 | $135,008,825,500 | $137,436,117,500 | 1.80% |

Operating and capital grants

Operating and capital grants ewilliamOperating grants

Operating grants from the Victorian and Australian Government help us deliver services to ratepayers. Operating grants can be either:

- recurrent, meaning they are received each year

- non-recurrent, meaning they are once off or short term.

For 2023–24, we have budgeted an increase of 14.8% or $1.71 million, compared to the 2022–23 forecast. This is due to a:

- $3.68 million increase in recurrent operating grants. This is mainly because the Victorian Local Government Grants Commission (VLGGC) brought forward 75% or $3.93 million of the 2022–23 allocation to the 2021-22 financial year, compared to a full year allocation in 2023–24

- partial offset of non-recurrent operating grants decreased by $1.97 million, mainly due to less grant funding opportunities in 2023–24.

After adjusting for the Victorian Local Government Grants Commission, the total for operating grants is expected to decrease by 18.3%. The decrease in operating grants and subsidies shows that the trend of grant income is not keeping up with the spending required to deliver services to the community. As a result, there is an increasing financial burden on Council and our ratepayers.

Capital grants

Capital grants from the Victorian and Australian Government and community sources help us fund the Capital Works Program.

The amount of capital grants we receive each year can change a lot depending on the type of works in the Capital Works Program.

Capital grants can be either:

- recurrent, meaning they are received each year

- non-recurrent, meaning they are once off or short term.

For 2023–24, we have budgeted for capital grants funding of $3.24 million. This is a decrease in capital grant funding of $11.15 million compared to 2022–23.

The largest grants for 2023–24 include:

- $2.05 million from the Australian Government for Walmer Street bridge works

- $593,811 from the Australian Government Local Road and Community Infrastructure Program for Willsmere Park Pavilion and Lynden Park Pavilion

- $593,811 from the Australian Government Roads to Recovery Program covering roads pavement renewal works.

Capital Works Program 2023–24

Capital Works Program 2023–24 ewilliamWhere Capital Works Program funding comes from

Our Capital Works Program totals $80.60 million. This is made up of:

- $67.09 million from Council operations (funded by rates)

- $3.24 million from external grants and contributions

- $4.72 million from asset sales

- $5.55 million from Council cash (carried forward works from 2022–23).

How we will spend the Capital Works Program funding

The funding for each project group is a forecasted amount for the 2023–24 year. The actual amount we spend could be more or less than this.

Detailed list of capital works

The capital works projects are grouped by class and include:

- new works for 2023–24

- works carried forward from the 2022–23 year.

Priority Projects

Priority Projects ewilliamOur Priority Projects program provides funding for short-term projects or pilot initiatives. This allows us to deliver on important issues for the community, while making sure that project funding doesn’t become part of the recurrent operating budget. It is another example of our commitment to financial sustainability, transparency and accountability.

In 2023–24, we have planned Priority Projects for the coming year and provided details for projects over the next 3 years.

The Priority Projects budget for 2023–24 includes projects that support all of our strategic objectives.

These projects include:

- implementing the Urban Biodiversity Strategy

- investigation and design of the Box Hill to Hawthorn Strategic Cycling Corridor.

Borrowings

Borrowings ewilliamBorrowings history

During the 2012–13 financial year, we borrowed $29 million to fund major building works. The borrowings were at a fixed interest rate for 10 years and we were due to repay this in full in 2022–23. However, during the 2022–23 financial year, we reviewed our existing loan portfolio and refinanced the rest of this loan for another 10 years.

We expect to repay all existing borrowings by 2033.

Existing borrowings

During the 2022–23 year, we made $25.91 million in principal repayments on existing borrowings. This means that on 30 June 2023, our total borrowings will be $85.33 million. The projected cost of servicing these borrowings is $8.12 million during 2023–24.

Future borrowing strategy

Our borrowing strategy is to pay off existing debt over time so that we can look at new borrowings for significant infrastructure projects for the community. This strategy allows us to invest in new infrastructure while paying off our debts.

We will look at different borrowing strategies for each area of planned borrowings as they become due.

Future proposed borrowings

The following table sets out our future proposed borrowings, based on our forecast position on 30 June 2023.

| Financial year ending | New borrowings | Principal paid | Interest expense | Balance 30 June |

|---|---|---|---|---|

| 2023 | 19,700,000 | 25,907,000 | 3,952,000 | 85,333,000 |

| 2024 | – | 8,117,000 | 3,408,000 | 77,216,000 |

| 2025 | – | 8,460,000 | 3,063,000 | 68,755,000 |

| 2026 | – | 8,819,000 | 2,703,000 | 59,936,000 |

| 2027 | – | 8,659,000 | 2,353,000 | 51,277,000 |

| 2028 | – | 9,015,000 | 1,996,000 | 42,262,000 |

| 2029 | – | 9,386,000 | 1,625,000 | 32,876,000 |

| 2030 | – | 9,773,000 | 1,239,000 | 23,103,000 |

| 2031 | – | 10,175,000 | 836,000 | 12,928,000 |

| 2032 | – | 10,594,000 | 417,000 | 2,334,000 |

| 2033 | – | 2,334,000 | 69,000 | – |

| Total | 19,700,000 | 111,239,000 | 21,661,000 | – |

Statement of borrowings

| Indicator | Forecast Actual 2022–23 | Budget 2023–24 |

|---|---|---|

| Total amount borrowed as at 30 June of the prior year | $91,540,000 | $85,333,000 |

| Total amount to be borrowed | $19,700,000 | $0 |

| Total amount projected to be redeemed | – $25,907,000 | – $8,117,000 |

| Amount of borrowings 30 June | $85,333,000 | $77,216,000 |

Leases in our community

Leases in our community ewilliamLease of land

Under section 115 of the Local Government Act 2020, we have the power to lease any land to any person for a term of 50 years or less. However, this is still subject to any other act and where section 116 of the Local Government Act 2020 applies. If we lease any land to any person subject to any exceptions, reservations, covenants and conditions, it must comply with this section.

We must include any proposal to lease land in a financial year in the budget, where the lease is for one year or more and:

- the rent for any period of the lease is $100,000 or more a year

- the current market rental value of the land is $100,000 or more a year

- for 10 years or more.

If we propose to lease land (subject to the 3 criteria noted above) and that was not included as a proposal in the budget, we must complete a community engagement process in line with our community engagement policy before entering into the lease.

The proposed community leases set out in the table are in line with our Council Assets – Leasing and Licensing Policy 2017 and our Boroondara Community Plan 2021–31.

Our in-house Senior Valuer provides us with market rental valuations. All rentals proposed to be charged are in line with our Council Assets – Leasing and Licensing Policy.

| Tenant | Property | Proposed term | Annual Market Rental Valuation (excluding GST) |

Proposed Annual Rental (including GST) |

|---|---|---|---|---|

| Access Health and Community operating as headspace Hawthorn | Part level 1 Hawthorn Arts Centre 360 Burwood Road Hawthorn 3122 |

5 years | $121,200 | $50,948.62 |

This property will operate as headspace Hawthorn and will provide early intervention, care and services for young people aged from 12 to 25 years.

These services will include:

- mental health support

- physical health support

- vocational support

- drug and alcohol support services.